Why are mortgage rate up after the Fed reduced interest rates?

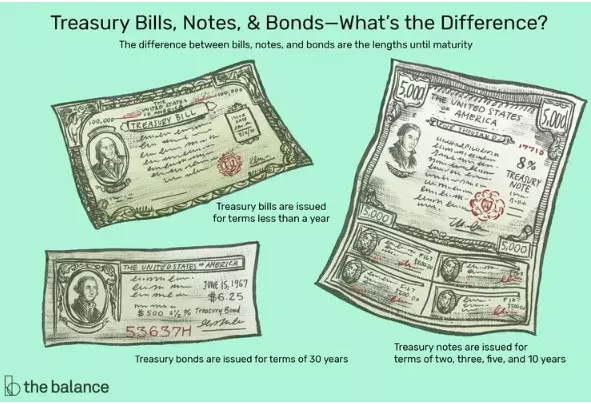

Are you wondering why mortgage rates are up after three rate cuts in 2024? It's because mortgage rates follow the rates of their close competitor, 10 year Treasury Notes.

1. Investor Behavior and Risk Profile

- Treasuries: 10-year Treasury notes are considered a safe investment with a predictable return, backed by the U.S. government.

- Mortgages: Mortgage-backed securities (MBS), which fund home loans, are riskier but have a comparable time horizon since many homeowners refinance or sell within 10 years.

- Investors seeking slightly higher returns may prefer MBS over Treasuries, but their yields must stay competitive to attract buyers. If Treasury yields rise, mortgage rates often increase to maintain this balance.

2. Inflation Expectations

Both Treasuries and mortgages are affected by inflation. Higher inflation expectations push yields and mortgage rates up because lenders demand more return to offset the erosion of purchasing power.

3. Economic Indicators

Economic growth impacts both Treasuries and mortgage rates. For example:

- Strong Growth: Leads to higher Treasury yields and mortgage rates, as demand for credit increases.

- Weak Growth or Recession: Pushes rates down as investors move to safe assets like Treasuries, and the Federal Reserve may lower interest rates to stimulate borrowing.

4. Spread Between Treasuries and Mortgages

Mortgage rates don't perfectly match 10-year Treasury yields; there’s a spread to account for:

- The risk of borrower default.

- Administrative and operational costs for issuing loans.

- Market conditions like supply and demand for MBS.

Summary

The 10-year Treasury yield acts as a benchmark because its maturity closely aligns with the average lifespan of a mortgage, reflecting similar economic influences. However, mortgage rates include additional risk premiums, making them slightly higher.

Categories

Recent Posts

Why are mortgage rate up after the Fed reduced interest rates?

Transfer on Death Deed

Tree Farm

Charming Corner Lot Home in South Austin with Modern Updates and Classic Elegance

Understanding ASR in Pool Concrete: Essential Insights for Agents, Homeowners, and Buyers

Join Us for a Tree-Planting Event at Zilker Elementary!

Open House Nov 16 1-3PM : 3113 Sesbania Dr, Austin, TX

Charming Newly Renovated Duplex in Taylor, TX - Perfect for Modern Living

Open House 5506 Salem Walk Sunday Oct 20th 1-3PM

Discover the Perfect Blend of Comfort and Convenience at 5219 Summerset TRL, Austin, TX 78749